3. Cash Yield Computations

Cash yields are an integral part of private market performance, and ignoring them can lead to a biased underestimation of potential returns.

Dividend data of private companies are not uniformly reported or captured systematically.

We model payout ratios of tracked companies using macroeconomic data on profits and dividends.

Time-varying estimated payout ratios are then applied to our indices to compute cash yields and total returns.

In this section, we detail our estimation procedures for the cash yield component of private asset valuation used in the construction of the market indices, PEU, and BMU benchmarks. Our top-down approach to estimating cash yields can produce time-varying cash yields at the private company level that vary according to its profitability and sectoral trends in profits and dividends paid.

Why are cash yields important?

Dividends have played a significant role in returns in public markets. For example, 32% of total returns generated by the S&P 500 index during 1926-2019 are attributable to dividends (Watts and Barrera, 2023). Moreover, even in private markets, the sustained growth in dividend recapitalisations, i.e., issuing debt to pay dividends by private equity owners, during 2000-2022 suggests dividends form an important source of performance for private companies (LaCroix, 2023).

To compute total return indices, an estimate of dividends paid by private companies is required. Even if unobservable, dividends enhance investor’s returns and increase the attractiveness of investing in private companies. However, ignoring dividends can understate the performance of private company investments, thus leading to incorrect asset allocations.

Thus, a model of dividends of private companies, if realistic, can make up for the unobservability and produce realistic benchmarks. The role played by estimated cash yields in the process of benchmark construction is shown below:

Model an unobservable price based on transactions happening in the private markets for each private company. Aggregate the prices of different constituents in the index to arrive at the price return of the index over a time period.

Model an estimated dividend yield by the proposed method in this document.

Compute the estimated dividends across all the index constituents and assume reinvestment at index prices to compute total returns over periods (see Figure below).

An Illustration of Price & Total Returns

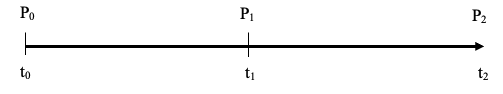

For example, consider a private company valued at time t = 0,1, and 2 at values P0, P1, and P2. The price return over periods 1 and 2 can be expressed as:

Over the entire holding period, the price return (i.e., ignoring dividends) can be expressed as:

or

where the second expression ignores the interim valuation at period 1.

However, if we assume at t1 and t2, dividends D1 and D2 are paid, then the total return over the entire period is given by the below. Also, the second expression ignores the interim valuation, except for the growth in reinvested dividends which depends on P1.

or

Thus, even in this simple example, D1 is reinvested for a single period and D2 enhances returns in the final period. Moreover, over longer time horizons, such as common in private assets, the potential of dividends to distort observed performance is significantly higher. The objective of this exercise is to get accurate estimates of the dividend stream (e.g., D1, D2, etc) to compute indices that represent the total return performance of private assets very precisely.

A variety of methods are possible to model the cash yields of private companies such as:

Using actual data of dividends in a large sample of private company financial information

Estimate dividends of private companies using indirect methods, i.e., based on detailed private company financial information

Build a model that relies on public market dividends properly accounting for private market characteristics

Use private sector macro dividend information and make adjustments for public market payouts

The following sections explore each of these options before providing more detailed information on our chosen method, which is 4), i.e., using private sector macro dividend information and making adjustments for public market payouts.

LaCroix, K. (2023). Dividend Recaps: Potential Risks for Private Equity Firms and Their Insurers. The D&O Diary. https://www.dandodiary.com/2023/10/articles/private-equity/dividend-recaps-potential-risks-for-private-equity-firms-and-their-insurers/

Watts, R., & Barrera, H. (2023). A Fundamental Look at S&P 500 Dividend Aristocrats. S&P Dow Jones Indices. S&P Global. https://www.spglobal.com/spdji/en/research/article/a-fundamental-look-at-sp-500-dividend-aristocrats/