1. privateMetrics® Market Indices

The flagship privateMetrics® market indices cover 30 countries that are most attractive to PE/VC investors.

Each country & PECCS™ activity (sector) within a country is represented in the market index according to its pro-rated economic importance in the global economy, adjusted for the investability in private assets.

From the eligible universe of private companies, the largest in each country-PECCS™ activity is included in the index.

Indices are regularly maintained for public listings, acquisitions, and liquidation events.

Annually, indices are also rebalanced in June to update for changes in country weights, PECCS™ activity weights, and market caps.

The flagship market indices include the private2000, privateUS, privateEurope, and privateAPAC.

privateMetrics® offers equity index series that combines the performance of a large number of private companies globally to reflect the overall, segment-wise, and regional performance of the private asset class in a precise, granular, and frequent manner while avoiding the usual biases of estimated, appraised, or self-reported data commonly part of other private market benchmarks.

The key indices include the namesake privateMetrics® Market Indices and the PEU/BMU Benchmarks. The flagship privateMetrics® Market Indices reflect the performance of key segments in the private markets, including the aggregate market and key geographies of interest to investors. The PEU/BMU Benchmarks are the result of several hundreds of combinations of the PECCS™ classification, geographic regions, and styles of private companies, built from the Private Equity-backed Universe (PEU) and the Broad private Market Universe (BMU), respectively.

We explain our detailed methodology for arriving at the list of eligible companies that can be considered for index inclusion (universe determination) and determination of actual index constituents for the flagship privateMetrics® Market Indices, which include the private2000 and three other indices in the following pages. The private2000 index is designed to capture the pricing dynamics of the largest 2,000 companies in 30 countries that rank as the most attractive for private equity investors in the world. The companies in the private2000 form the Market Index Universe (or MIU), which are then segmented into three key geographical markets, including the United States (privateUS), Europe (privateEurope), and Asia-Pacific (privateAPAC).

Note that the PEU and BMU Benchmarks are combinations of PECCS™ classes, subclasses, regions, countries, and styles from the PE-backed and Broad Market Universes, respectively. The number of constituents, the index entrants, and the index exits are not strictly monitored, and any expansion to coverage can be applied in the future.

In summary, the methodology includes:

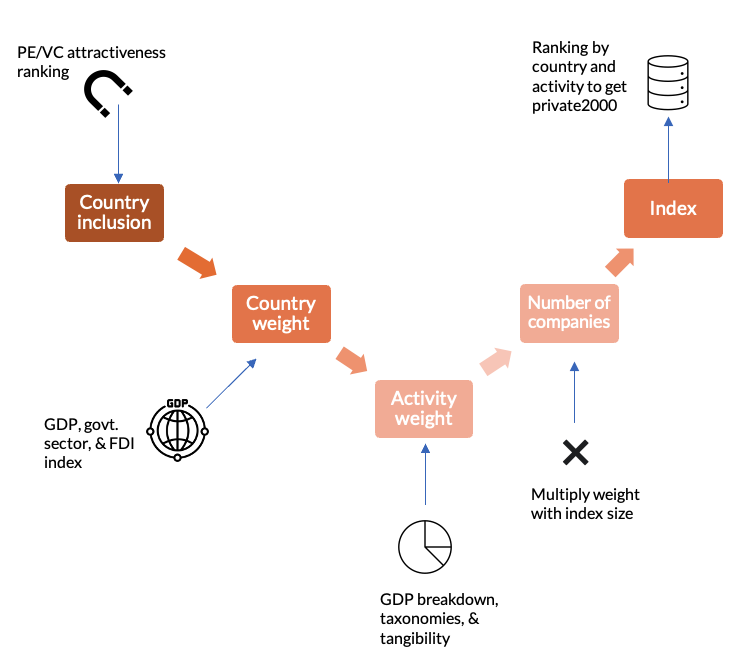

The figure below presents a summary of the privateMetrics® Flagships index methodology. Note that this is a static snapshot of the process, whereas the actual index construction is a dynamic process. This process also considers whether the considered companies were part of the index in the past or are new entrants, implementing different standards for the two types.

Static index methodology for flagship privateMetrics® indices

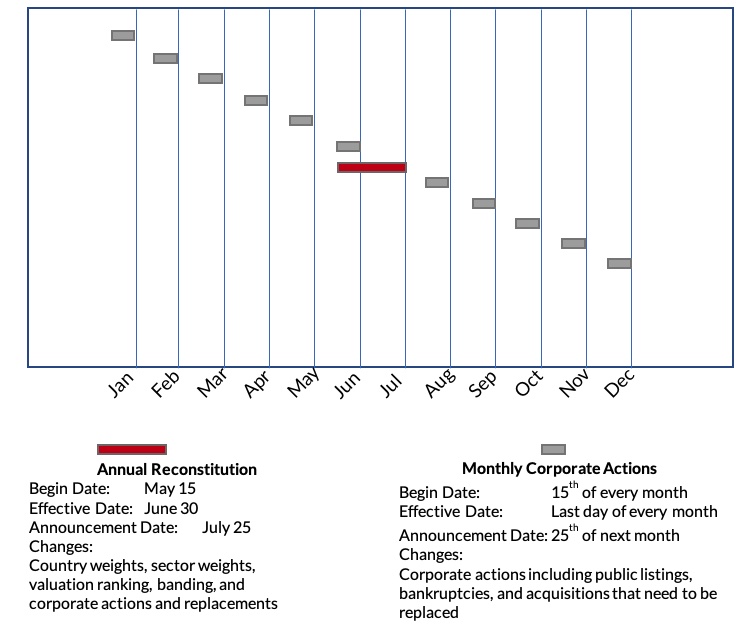

The figure below shows the dynamic index maintenance features of the flagship indices, explaining the monthly and annual processes around index maintenance. The dates are for illustration, and the actual release of monthly updates will differ.

Dynamic index maintenance calendar for flagship privateMetrics® indices