1.2.2 PRIVATEMETRICS.INFRA_EQUITY_COMPARABLE

INFRA_EQUITY_COMPARABLE (METRIC, CURRENCY, AGEINMONTHS, ENDDATE, WINDOWINYEARS, INDUSTRIALACTIVITIES, BUSINESSRISK, CORPORATESTRUCTURE, COUNTRIES, SIZE, LEVERAGE, PROFITABILITY, INVESTMENT, TIMETOMATURITY, TYPE)

Perform a comparable computation for private infra equity. This involves finding datapoints which have similar TICCS classifications and factor values (the comparables dataset) and averaging the metric values

Parameters

METRIC: Text

The Metric for which the comparable has to be evaluated. (“ev2ebitda”, “irr”, “p2b”, “p2sales”, “premia”, “wacc”, “revenue_growth”)

CURRENCY: Text

The currency of monetary factor inputs such as SIZE ('USD', ‘EUR’, ‘GBP’)

AGEINMONTHS: Number

The age of the company in months. The comparable computation will keep companies within 6 months of this value. If set, ENDDATE and WINDOWINYEARS will be ignored

ENDDATE: Date

The max date of the comparable dataset

WINDOWINYEARS: Number

The window in years of the comparable dataset. In other words, the min date of the comparable dataset = ENDDATE - WINDOWINYEARS

INDUSTRIALACTIVITIES: Range(Text), Text

Comma-separated or cell range selection of industrial activity TICCS code. See here for definitions. (“IC10”, “IC20”, “IC30”, “IC40”, “IC50”, “IC60”, “IC70”, “I80”, “IC6010”, etc.. Different industrial activity levels can be combined.)

BUSINESSRISK: Text

Business risk TICCS code. See here for definitions. (“BR1”, “BR2”, “BR3”)

CORPORATESTRUCTURE: Text

Corporate structure TICCS code. See here for definitions. (“CS1”, “CS2”)

COUNTRIES: Range(Text), Text

Range of countries as three-letter ISO code. The possible values can be obtained by calling PRIVATEMETRICS.COUNTRIES()

SIZE: Number (Million)/ Text

Total assets. Absolute value (in CURRENCY) or quintile (“Q1”, “Q2”, “Q3”, “Q4”, “Q5”)

LEVERAGE: Number (Percentage)/ Text

Total senior liabilities over total assets. Percentage value or quintile (“Q1”, “Q2”, “Q3”, “Q4”, “Q5”)

PROFITABILITY: Number (Percentage)/ Text

Return on assets. Percentage value or quintile (“Q1”, “Q2”, “Q3”, “Q4”, “Q5”)

INVESTMENT: Number (Percentage)/ Text

CAPEX over total assets. Percentage value or quintile (“Q1”, “Q2”, “Q3”, “Q4”, “Q5”)

TIMETOMATURITY: Number/ Text

Years until maturity. Years or bucket (“T1”, “T2”, “T3”, “T4”, “T5”). The buckets cover the following ranges:

T1: 0-5 years, T2: 5-10 years, T3: 10-15 years, T4: 15-20 years, T5: 20+ years

TYPE: Text

To determine how to aggregate the comparables dataset. The default is “mean”. (“mean”, “median”, “obs_count”, “company_count”, “p25”, “p75”, “min” and “max”)

p25 and p75 are the 25th and 75th percentile respectively

Returns

number

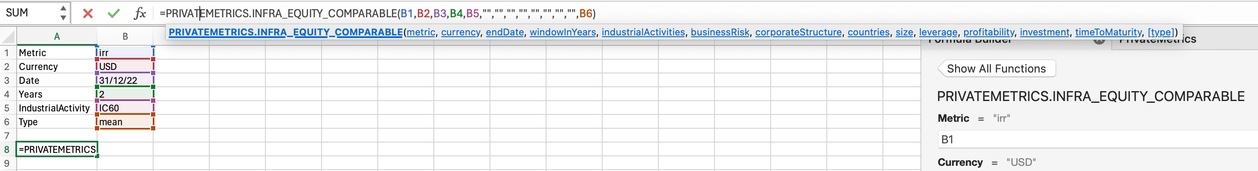

Examples

=PRIVATEMETRICS.INFRA_EQUITY_COMPARABLE("irr", "USD", , DATE(2022,12,31), 2, "IC60","","","","","","","","","mean")Returns

9.3%

This can also be called by referencing values from the spreadsheet