2.2.4 Multicollinearity check

Model robustness may be adversely affected when the covariates are highly correlated. Therefore, before describing our estimation procedure, we briefly discuss the correlations among the covariates.

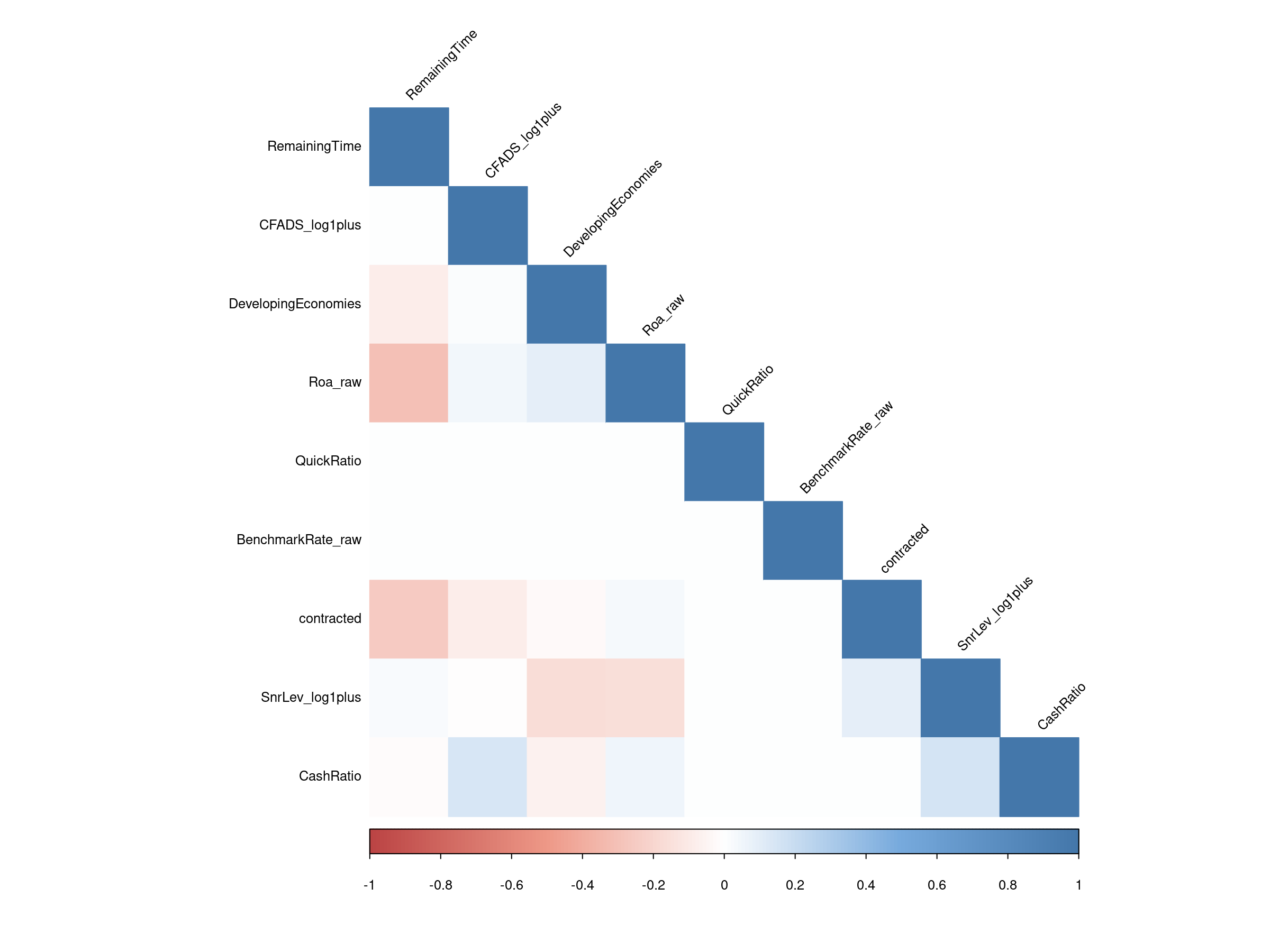

Correlation matrixes show weak correlations among the variables.

Correlation matrix for project debt

Correlation matrix for corporate debt

In our analysis of corporate and project debt models, we observed predominantly weak correlations among the variables, suggesting limited linear relationships between them. These findings imply that the variables included in the models exhibit minimal dependence on one another in terms of linear associations. Such weak correlations can have significant implications for model development and interpretation, as they indicate that the variables may not directly influence each other’s behaviour in a linear fashion. Consequently, the impact of multicollinearity, a common concern in regression analysis, may be less pronounced. However, it is important to note that while weak correlations may mitigate multicollinearity issues, they do not necessarily imply independence between variables. Thus, careful consideration of variable relationships and potential nonlinear associations remains crucial for robust model development.